Ipiphany

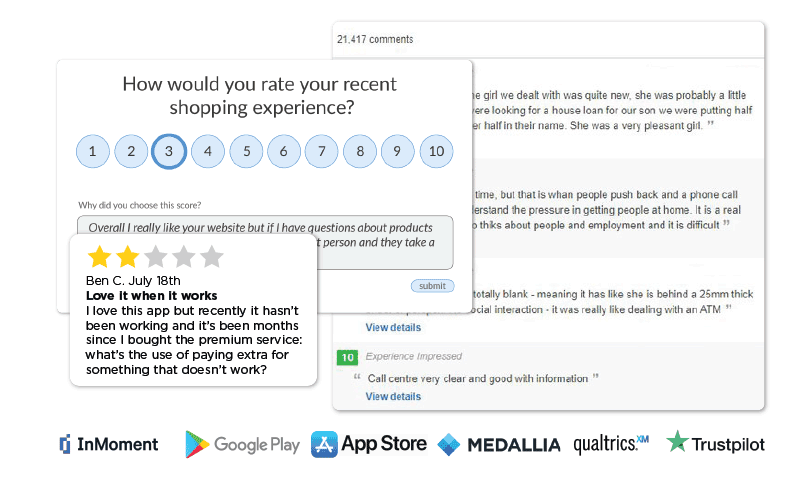

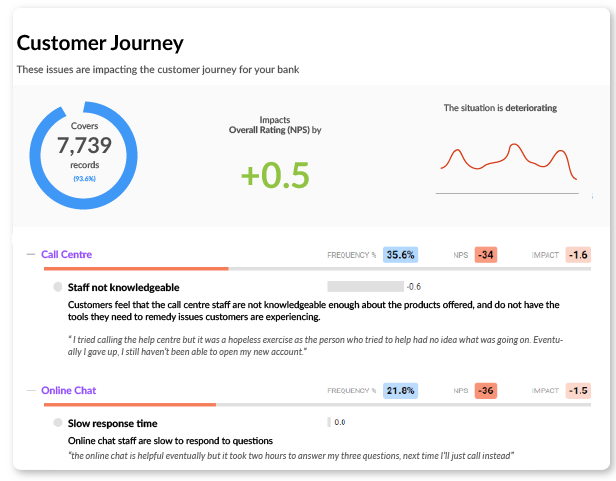

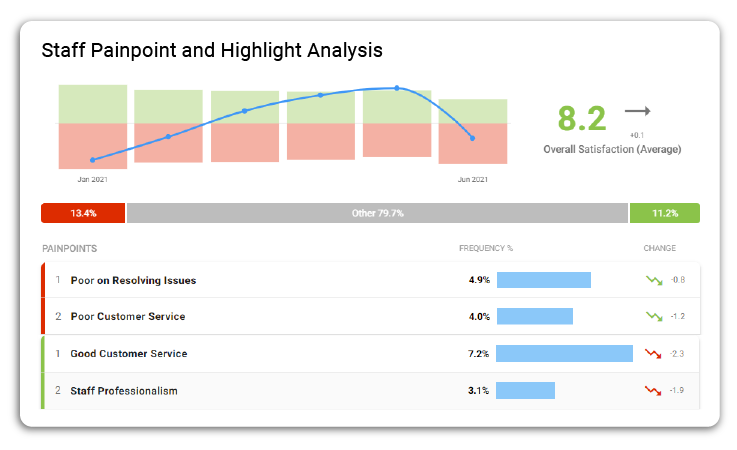

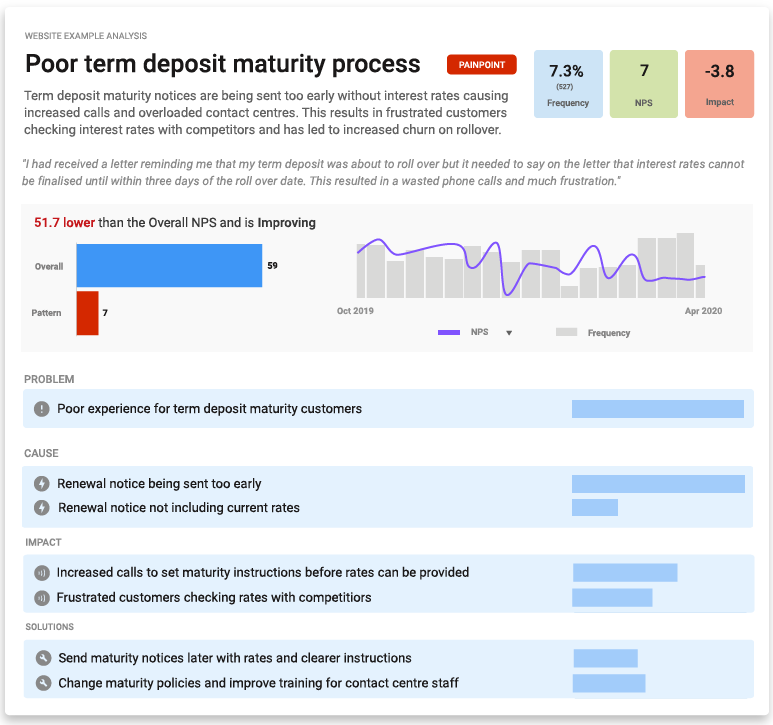

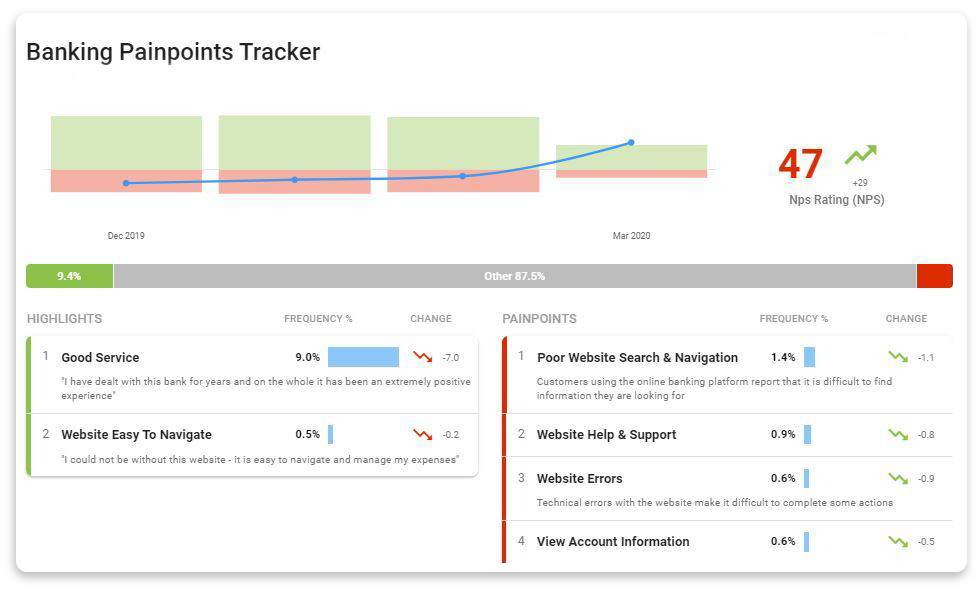

Your customers are trying to tell you something. Are you listening? Understand what issues your customers experience - and why - so you can maximise the outcome of business improvements with measurable results. Ipiphany reads your customer feedback at speed by applying a contextual understanding of your business to understand the implications of customer comments on metrics like NPS, CSAT, and ROI.